Market Definition

The market encompasses the comprehensive landscape of technologies, tools, services, and applications involved in the large-scale study of small molecules or metabolites, within biological systems.

This market includes a range of analytical platforms such as Nuclear Magnetic Resonance (NMR) Spectroscopy, Mass Spectrometry (MS), and Chromatography techniques (including Gas Chromatography (GC) and Liquid Chromatography (LC)), which are central to metabolite identification, quantification, and profiling. The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period.

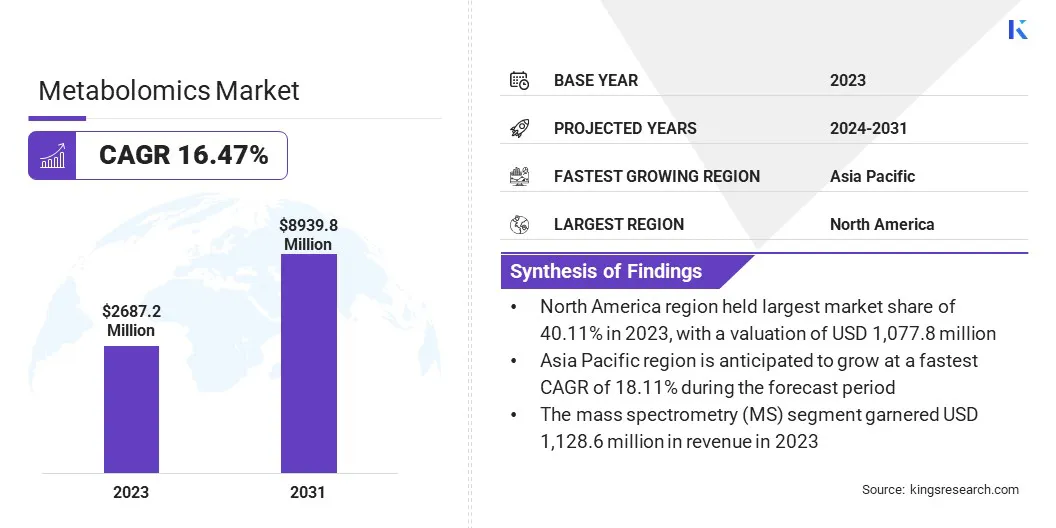

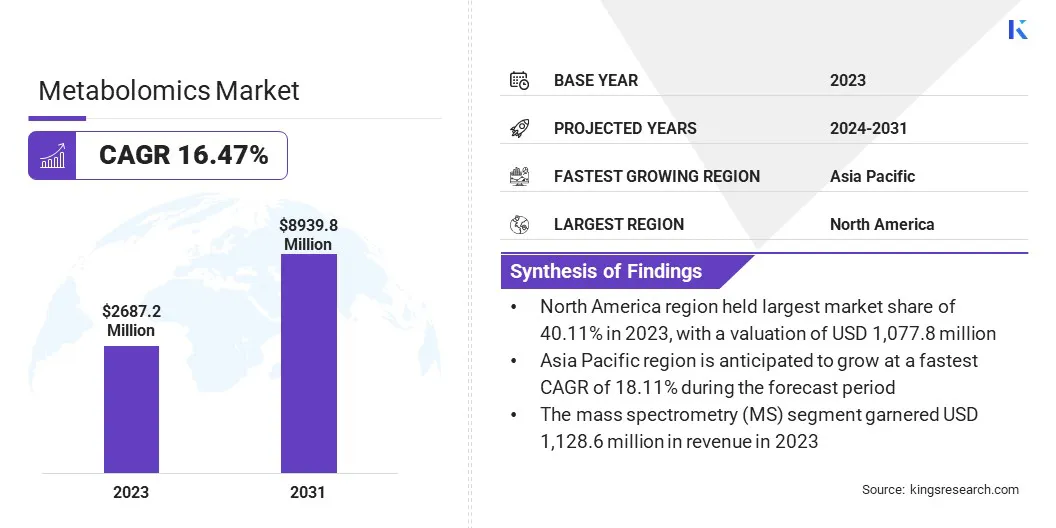

The global metabolomics market size was valued at USD 2,687.2 million in 2023 and is projected to grow from USD 3,074.5 million in 2024 to USD 8,939.8 million by 2031, exhibiting a CAGR of 16.47% during the forecast period.

The growth is driven by its expanding role in disease diagnosis, drug development, and personalized medicine. The rising global incidence of cancer has significantly increased the demand for metabolomics in oncology research. Metabolomics enables the identification of cancer-specific biomarkers and metabolic pathways, supporting early detection, patient stratification, and targeted therapy development.

Major companies operating in the metabolomics industry are Bio-Rad Laboratories, Inc., DH Life Sciences, LLC., JASCO, GL Sciences Inc., Waters Corporation, PerkinElmer Inc., Shimadzu Corporation, LECO Corporation, Merck KGaA, Agilent Technologies, Inc., SCION Instruments, Metabolon, Inc., Thermo Fisher Scientific Inc., Hitachi High-Tech Corporation, and Bruker.

Moreover, the integration of AI and ML is enhancing the efficiency and innovation within metabolomics workflows. These technologies are streamlining research methodologies, improving biomarker discovery, and accelerating biological interpretation, which in turn is boosting adoption across pharmaceutical, clinical, and academic sectors.

- In February 2024, Sapient launched its high-throughput discovery proteomics services, further strengthening its mass spectrometry-based biomarker discovery platform to support metabolomics and lipidomics research. This expansion enhances Sapient’s multi-omics capabilities, enabling integrated analysis across a large number of samples to accelerate biomarker discovery in metabolomics-driven applications for biopharma and academic research.

Key Highlights

- The metabolomics industry size was recorded at USD 2,687.2 million in 2023.

- The market is projected to grow at a CAGR of 16.47% from 2024 to 2031.

- North America held a market share of 40.11% in 2023, with a valuation of USD 1,077.8 million.

- The mass spectrometry (MS) segment garnered USD 1,128.6 million in revenue in 2023.

- The pharmaceutical & biotech companies segment is expected to reach USD 3,601.5 million by 2031.

- The biomarker discovery segment is expected to reach USD 2,927.8 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 18.11% during the forecast period.

Market Driver

Rising global cancer incidence

The market is driven by the rising global incidence of cancer, which is accelerating the need for advanced diagnostic and therapeutic tools. As cancer remains one of the leading causes of death worldwide, there is a growing demand for technologies that enable early detection, precise disease characterization, and personalized treatment planning.

Metabolomics enables the identification of cancer-related biomarkers by analyzing metabolic alterations linked to disease progression. This capability supports early diagnosis and treatment planning, making metabolomics a valuable asset in oncology research and precision medicine, and accelerating its adoption across clinical, pharmaceutical, and academic sectors.

In February 2024, the World Health Organization (WHO) reported that global cancer cases are projected to exceed 35 million annually by 2050, reflecting a 77% increase from the estimated 20 million cases in 2022. This increase is largely attributed to lifestyle and environmental factors, including higher rates of tobacco use, alcohol consumption, obesity, and exposure to air pollution.

Market Challenge

Lack of Standardization

A major challenge facing the metabolomics market is the lack of standardization across analytical platforms and data interpretation methods. Due to the diversity of technologies used such as NMR spectroscopy, mass spectrometry, and various chromatography techniques, results can vary significantly depending on instrumentation, sample preparation, and analysis protocols.

To address this, key players are collaborating with regulatory agencies, academic institutions, and industry groups to develop harmonized methodologies. These efforts focus on establishing uniform data processing protocols, quality control benchmarks, and validation frameworks. Standardization is expected to improve cross-platform data comparability, streamline regulatory pathways, and build greater trust in metabolomics-based applications in clinical diagnostics and pharmaceutical research.

Market Trend

Integration of Artificial Intelligence and Machine Learning

The market is experiencing a key trend in the integration of AI and ML to enhance research efficiency and innovation. These technologies are being increasingly incorporated into various stages of the metabolomics workflow, such as experimental design optimization, feature selection, and biological pathway prediction. AI and ML are enabling faster hypothesis generation and facilitating the discovery of complex metabolic interactions involved in diseases.

- In March 2025, Linearis inaugurated its high-throughput metabolomics platform and modernized laboratory in Quebec City, integrating AI to support life sciences research. The platform enables automated analysis of approximately 1,300 metabolic biomarkers, offering tailored services to biobanks, clinical research groups, and biopharmaceutical companies.

|

Segmentation

|

Details

|

|

By Technique

|

NMR Spectroscopy, Mass Spectrometry (MS), Chromatography (GC/LC), Others

|

|

By End User

|

Pharmaceutical & Biotech Companies, Academic & Research Institutes, Contract Research Organizations, Hospitals & Clinics, Others

|

|

By Application

|

Biomarker Discovery, Drug Discovery & Development, Clinical Diagnostics, Toxicology Testing, Nutrition & Functional Genomics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technique (NMR Spectroscopy, Mass Spectrometry (MS), Chromatography (GC/LC), Others): The Mass Spectrometry (MS) segment earned USD 1,128.6 million in 2023 due to its high sensitivity, accuracy, and ability to analyze complex biological samples for metabolite profiling.

- By End User (Pharmaceutical & Biotech Companies, Academic & Research Institutes, Contract Research Organizations, and Hospitals & Clinics): The Pharmaceutical & Biotech Companies held 38.12% of the market in 2023, due to their increasing reliance on metabolomics for drug discovery, personalized medicine, and biomarker validation.

- By Application (Biomarker Discovery, Drug Discovery & Development, Clinical Diagnostics, Toxicology Testing, Nutrition & Functional Genomics, Others): The Biomarker Discovery segment is projected to reach USD 2,927.8 million by 2031, owing to the rising demand for early disease diagnosis and advancements in precision medicine.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America metabolomics market share stood at around 40.11% in 2023 in the global market, with a valuation of USD 1,077.8 million. This dominance is primarily driven by the strong presence of leading pharmaceutical and biotechnology companies, advanced healthcare infrastructure, and significant investments in R&D by governments.

Additionally, robust government and private sector funding for precision medicine and omics research are increasing the adoption of NMR spectroscopy and mass spectrometry, in turn, further fueling market growth. The presence of key industry players and a well-established regulatory framework also contribute to the region’s leadership position.

- In February 2023, the Icahn School of Medicine at Mount Sinai in New York launched a neurometabolism program focused on combining research with clinical care for patients with brain metabolic diseases. The initiative aims to advance the understanding and treatment of neurological conditions influenced by metabolic dysfunction through global research collaborations.

Asia Pacific is poised to grow at a significant growth at a CAGR of 18.11% over the forecast period, driven by the expanding pharmaceutical and life sciences sector, increasing focus on personalized healthcare, and rising government initiatives supporting biotech research.

Moreover, the growing availability of skilled professionals and expanding healthcare infrastructure is accelerating the adoption of metabolomics technologies across countries like China, India, and Japan. Rising awareness of early disease detection and expanding clinical research capabilities are further strengthening regional market growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) plays a key role in regulating metabolomics applications. The FDA also assesses metabolomics-based diagnostics under the Medical Device Regulation framework, especially when such tools are intended for clinical use or disease diagnosis.

- In Europe, the European Medicines Agency (EMA) oversees the regulatory framework for metabolomics under the Committee for Medicinal Products for Human Use (CHMP). The EMA evaluates metabolomics data as part of biomarker validation and supports its integration into drug development through initiatives like the Innovative Medicines Initiative (IMI), which promotes the use of metabolomics in translational research and personalized medicine.

Competitive Landscape

The metabolomics market is highly competitive with key players focusing on strategic collaborations, mergers, and acquisitions to expand their technological capabilities and global footprint. Companies are increasingly investing in advanced analytical platforms and integrated software solutions to offer end-to-end metabolomics workflows.

A key strategy involves partnering with academic and research institutions to co-develop novel biomarkers and improve data interpretation tools. Market players are also enhancing their product portfolios through the development of high-throughput platforms combining mass spectrometry and chromatography with AI and ML for faster and more accurate metabolic profiling.

- In March 2025, Biocrates life sciences AG and Platomics collaborated to aid laboratories in ensuring and documenting the quality of their workflows using Biocrates’ metabolomics solutions. The partnership enables seamless integration of Biocrates’ quantitative metabolomics kits into Platomics’ PlatoX digital regulatory platform, for standardized documentation and reproducible results.

List of Key Companies in Metabolomics Market:

- Bio-Rad Laboratories, Inc.

- DH Life Sciences, LLC.

- JASCO

- GL Sciences Inc.

- Waters Corporation

- PerkinElmer Inc.

- Shimadzu Corporation

- LECO Corporation

- Merck KGaA

- Agilent Technologies, Inc.

- SCION Instruments

- Metabolon, Inc.

- Thermo Fisher Scientific Inc.

- Hitachi High-Tech Corporation

- Bruker

Recent Developments (Partnerships)

- In February 2025, Duke-NUS Medical School and the National University of Singapore Yong Loo Lin School of Medicine (NUS Medicine) jointly launched the Systems Metabolomics Centre (SysMeC). This collaborative research initiative aims to advance metabolomics research for precision medicine by enabling early disease detection and personalized treatment strategies through the large-scale study of metabolites in cells, tissues, and organisms.